Trend-following is a rules-based approach that buys strength and sells weakness. A trader enters in the direction of an established move and manages the position with predefined exits so winners can run while losses stay controlled.

Trend-following is a rules-based approach that buys strength and sells weakness. In practical terms, a trader enters in the direction of an established move and holds the position as long as the market continues to move with the trend. The principle “the trend is your friend” exists because sustained directional moves tend to travel farther than most anticipate, and a disciplined strategy aims to capture a meaningful slice of those moves. A trend following forex strategy is not about predicting tops and bottoms; it is about aligning with momentum that is already in motion and letting statistics play out over a large sample of trades.

This can be traded systematically with clear rules and repeatable management. Signals are defined by objective rules, and management is governed by predefined criteria. That systematism is essential because trend strategies deliver their edge unevenly. Historically, strong trends occupy only a fraction of market time; consequently, traders must accept many small scratches or losses while waiting for the extended moves. Expect many small losses or scratches during consolidation, with a smaller number of larger winners during sustained trends. The objective is to keep those losses small with sound risk management and allow the winners to run so that a few large gains more than pay for the cost of participation.

Professional application requires risk management anchored to market structure or volatility. Initial stops should be placed beyond recent swing highs/lows or at a volatility-adjusted distance based on recent price movement. Position sizing should be calibrated so that a string of small losses does not impair the account. When conditions align, this approach enables you to ride the trend forex with a clear plan for entries, exits, and position management.

|

Criteria |

What to do |

|---|---|

|

Trend direction (higher highs/higher lows for longs; lower highs/lower lows for shorts) |

Trade only in the direction of structure; if structure is unclear, stand aside. |

|

Trend strength confirmation (clean swings, limited overlap) |

If swings are clean and price isn’t chopping sideways, proceed; if overlap is heavy, be selective or wait. |

|

Entry trigger (candlestick pattern: pullback rejection, continuation) |

Enter only after a clear trigger; if there’s no trigger, wait. |

Identification: Define the dominant direction using market structure and confirm trend strength using clean swings and limited overlap. This narrows trading to markets currently trending.

Entry: Trigger only when your setup appears—such as a pullback that rejects a key level or a clear continuation pattern. Use limit or stop orders according to the setup logic to avoid impulsive entries.

Management: Predefine both risk and exit. Set the initial stop based on market structure or recent price movement, and update it systematically with a trailing methodology. Consider partial profits or scaling protocols that are explicitly laid out in your plan.

The key is consistency. Apply the same rules across pairs and timeframes. Record adherence in a journal, and review a large sample size to evaluate edge, not isolated outcomes.

Effective trend-following begins with a robust filtering process that distinguishes real directional movement from noise. A common approach is to define direction with market structure and confirm trend quality with clean swings and limited overlap. Using filters in combination raises the quality of signals and helps avoid the majority of range-bound whipsaws.

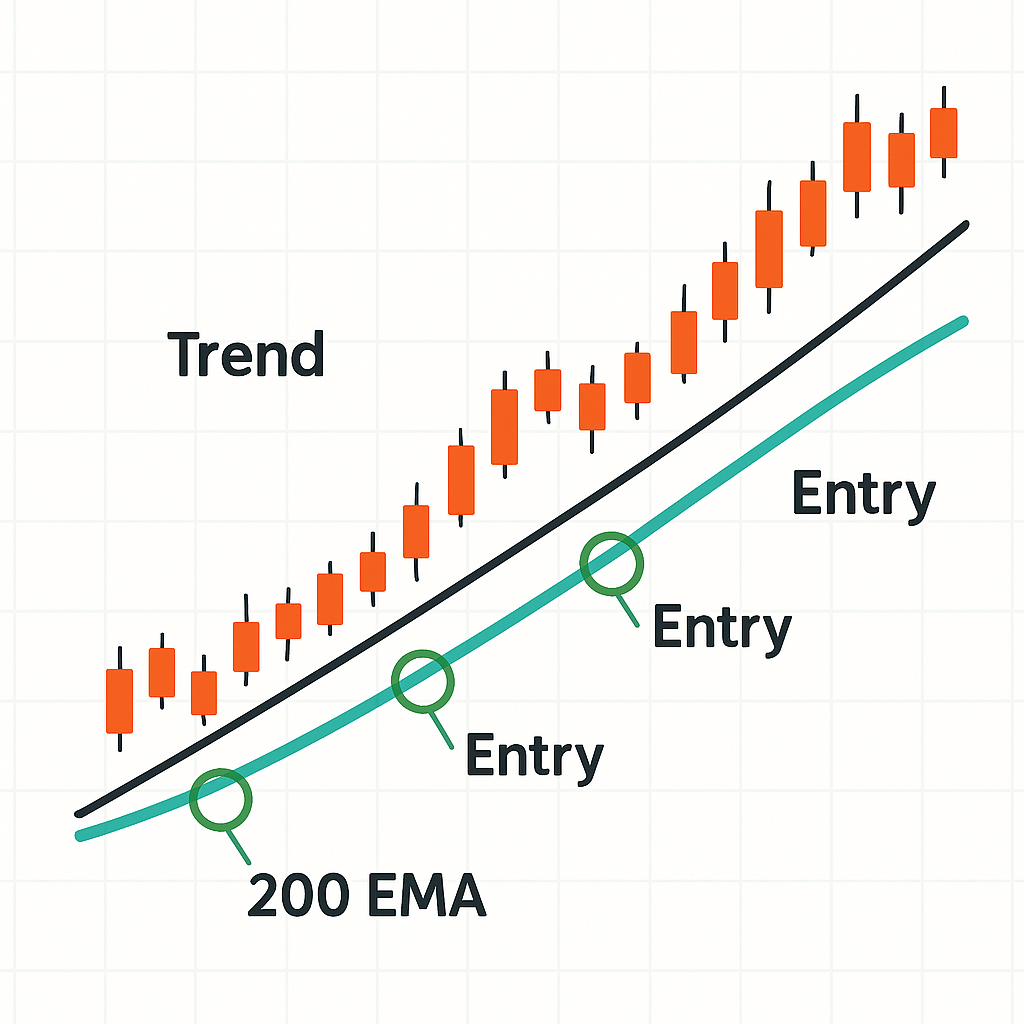

Some traders use the 200-period exponential moving average (EMA) as a long-term visual filter alongside market structure.

This kind of trend filter does not catch tops or bottoms; it intentionally engages after a trend is underway. The tradeoff for fewer false starts is occasionally getting in “late,” which is acceptable because trend-following aims for the middle of the move.

Once direction and strength are confirmed, entries seek to align with continuation rather than reversal. Use one or two preferred triggers and apply them consistently. Avoid mixing triggers arbitrarily; rule conflicts increase discretion and erode edge. Below are two practical ways to engage a continuation move.

Pullbacks buy dips in an uptrend or sell rallies in a downtrend, often providing better price and tighter risk. In a trend pullback entry forex approach, the setup waits for a retracement into a reference area (e.g., a moving average, broken resistance turned support, or a trendline), then requires confirmation that the trend is resuming.

Rules example (long):

This is frequently the safest method to engage a trend: the market has “proven” its intent by resuming higher after a controlled correction, allowing for superior reward-to-risk compared with breakouts.

Chart structures provide context for continuation. Recognizing a trend continuation setup helps sequence entries with the rhythm of the move.

Common patterns:

Rules example (long):

Trade management determines realized edge. The aim is asymmetry: small, frequent losses and a few outsized winners. To ride the trend forex effectively, keep exits as mechanical as entries. Your plan should define when to trail, when to scale, and when to stand aside. Discretion invites inconsistency; systematism maintains the edge through inevitable streaks.

A trailing stop dynamically follows price to protect open equity while leaving room for the trend to breathe. There are two practical approaches: structure-based and moving-average-based. Whichever you choose, write precise rules so the trailing stop trend forex is repeatable across trades and markets.

1) Structure-based trailing:

2) Moving-average trailing:

Hybrid models are common. For example, trail below the EMA 20 until an extended run develops, then switch to swing-lows to lock more profit. Define your switch rules explicitly—e.g., “after 3R open profit, switch to structural trailing.”

General guidelines:

Position scaling can increase efficiency if handled systematically.

Scaling in (add-ons):

Scaling out (partial profits):

The aim is not to maximize every trade, but to enforce a repeatable process that produces a favorable distribution over time.

Trend-following’s edge emerges across many trades, not every trade. The strategy’s risk profile is characterized by numerous small losses during choppy periods and occasional large gains during sustained moves. Understanding and planning for these risks is as important as signal selection.

Whipsaws are inevitable. During ranges, breakouts fail, moving average crossovers reverse quickly, and pullback confirmations morph into deeper corrections. Even with solid structure filters, expect clusters of small losses when the market refuses to trend.

Key considerations:

False breaks are a feature, not a bug. Your task is not to avoid them entirely but to ensure they are inexpensive.

Patience is integral for two reasons: signal scarcity in quiet markets and the need to hold winners. There will be extended periods without high-quality setups, especially if your rules require multi-timeframe alignment and strict trend-quality filters. Forcing trades during these lulls invites avoidable drawdowns.

Practical guidance:

Patience paired with rules allows the edge to surface when markets transition from range to trend.

A trend following forex strategy endures because it is grounded in market behavior: trends persist longer than most expect, and a systematic approach can capture a portion of those moves. The methodology is simple to state yet demanding to execute—apply objective criteria to define direction, use a clear trigger to enter, and manage positions with mechanical trailing stops and risk limits. Over many trades, the few large winners provide the bulk of returns while numerous small losses constitute the cost of staying engaged.

Consistency is the differentiator. A trend following system requires unwavering rule adherence through the inevitable periods of consolidation when losses accumulate. Prepare psychologically for clusters of small losses, and size positions so that losing streaks are tolerable. Use structure-based stops, keep direction anchored to market structure, and keep entries focused on pullbacks or well-defined trend continuation setups.

The objective is not perfection; it is to ride the trend forex with discipline. By codifying your identification, entry, and management rules—and by enforcing them trade after trade—you give yourself the best chance to participate meaningfully when markets trend and to protect capital when they do not.