Smart Money Concepts (SMC), often associated with ICT-style analysis, is a price-action framework that interprets market structure, liquidity, and imbalance to build a trade narrative. In practical terms, smart money concepts forex focuses on how price tends to interact with obvious highs/lows, stop clusters, and sharp “displacement” moves, and uses that context to plan bias, timing, and risk. Unlike indicator-driven systems, SMC/ICT contextualizes price action with market structure, liquidity engineering, and execution concepts (Order Blocks, Fair Value Gaps) that many traders use to map potential pullback zones after strong moves. If you’ve seen ICT-style trading content, the common workflow is multi-timeframe: define context on higher timeframes (H4/Daily) and look for cleaner entries on lower ones (M5/M15).

Smart Money Concepts (SMC) is a set of concepts used to read structure shifts, liquidity runs, and “imbalances” after sharp moves. It’s not a single indicator—more like a vocabulary and checklist traders apply to price.

|

Term |

Definition (Operational) |

|---|---|

|

SMC / ICT |

A price-action framework that uses market structure, liquidity, and imbalance concepts; many traders define context on higher timeframes and refine entries on lower timeframes. |

|

Market Structure |

The sequence of swing highs/lows that forms trends or ranges; used to define bias and context. |

|

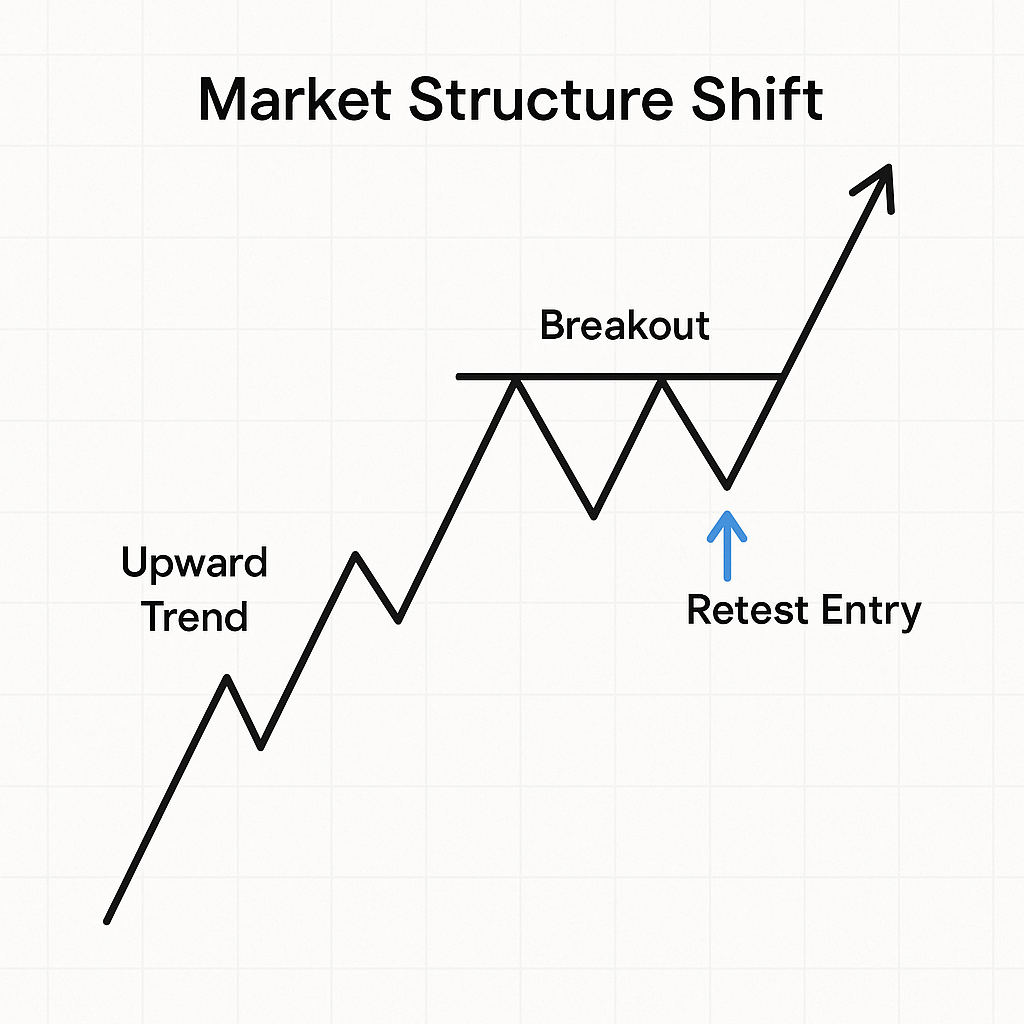

BOS (Break of Structure) |

Continuation cue: price breaks a prior swing in the direction of the prevailing move, suggesting momentum continuation. |

|

CHoCH (Change of Character) |

Potential reversal cue: price breaks the last meaningful opposing swing, suggesting the trend may be shifting. |

|

Liquidity Pool |

Areas where stops and pending orders often cluster (old highs/lows, equal highs/lows, obvious breakout points). |

|

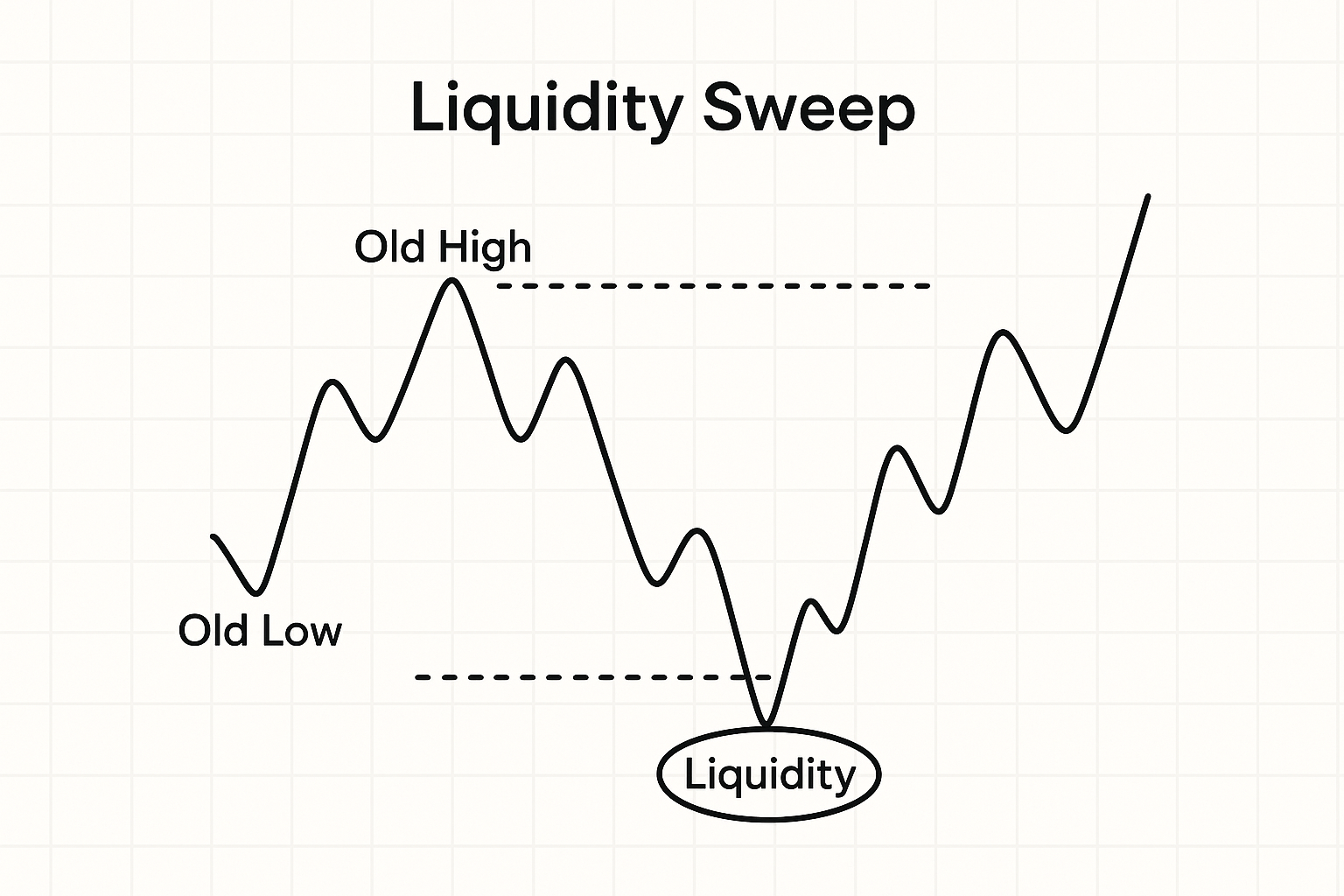

Liquidity Sweep |

A brief move beyond a liquidity pool followed by rejection (often interpreted as stop-taking before the real move). |

|

Inducement |

A “bait” move or structure that encourages early entries before price reaches the more important liquidity pool. |

|

Order Block (OB) |

The last opposing candle (or small cluster) before a sharp displacement; used as a potential pullback zone for entries and invalidation. |

|

Fair Value Gap (FVG) |

A three-candle imbalance (inefficient price delivery) that price may partially or fully retrace into later (“mitigate”). |

|

Breaker Block |

An invalidated order block that can flip role (support ↔ resistance) when price retests it after the break. |

|

Premium / Discount |

Relative pricing within a swing range: traders often look to sell from “premium” and buy from “discount” when aligned with bias. |

|

Mitigation |

Price revisiting an imbalance/zone (like an FVG or OB) after displacement; often used as entry timing. |

Institutions must source liquidity to enter and exit size without excessive slippage. That reality creates a recurring market behavior: price seeks liquidity pools around obvious technical levels, triggers stops or entices early entries, and then delivers in the intended direction. Many traders interpret these moves as breakouts. SMC-style traders instead wait to see if the breakout fails (sweep) and then look for confirmation before entering. In practice:

Crucially, SMC is not a “signal generator.” It is a framework that aligns bias, liquidity, and execution timing. The most consistent application uses multi-timeframe logic: H4/Daily for directional bias and key zones; M5/M15 for refined entries once liquidity and structure confirm.

Using SMC ideas in a bot-based app: most apps cannot automatically detect OBs/FVGs or “liquidity sweeps” as SMC defines them. The practical way to apply this in-app is to use SMC for manual analysis (mark key highs/lows and likely pullback zones), then run a single-pair bot that enters only after your chosen confirmation rules (for example: structure break + retest + candle confirmation), with hard stops and conservative size.

Market structure is the backbone of smart money concepts. A market structure shift occurs when price breaks the last meaningful swing in the opposing direction, indicating a potential reversal of trend. In operational language, market structure shift forex means identifying where the sequence of higher highs/higher lows or lower highs/lower lows has been interrupted decisively (a cleaner break, not just a wick).

Process:

Bias without multi-timeframe context is unreliable. The higher-timeframe structure defines the path; the lower-timeframe refines timing. FVGs and Order Blocks used for entries should be fresh and situated at areas of interest defined by the higher timeframe (premium/discount zones and major swing levels).

Execution guidance:

Liquidity is both target and fuel. Institutional execution depends on stop clusters and resting orders to transact size. The SMC workflow maps where liquidity likely resides, waits for the sweep or inducement, and only then aligns entries with structure and imbalance.

Common liquidity pools:

Operationally, price will often reach for the nearest pool before delivering. Your job is to avoid becoming the liquidity and instead wait for price to take it, displace away, and then offer a mitigation entry into a fresh OB/FVG consistent with higher-timeframe bias.

A liquidity sweep is a brief, intentional breach of a known liquidity pool that is quickly rejected, indicating stop collection and institutional absorption. In practice, liquidity sweep forex setups unfold as:

Risk protocol:

Inducement is a bait structure that lures traders into early entries before the true liquidity is harvested. A typical inducement forms just ahead of the real OB/FVG or just shy of the major pool. Inducement liquidity forex examples:

How to use inducement:

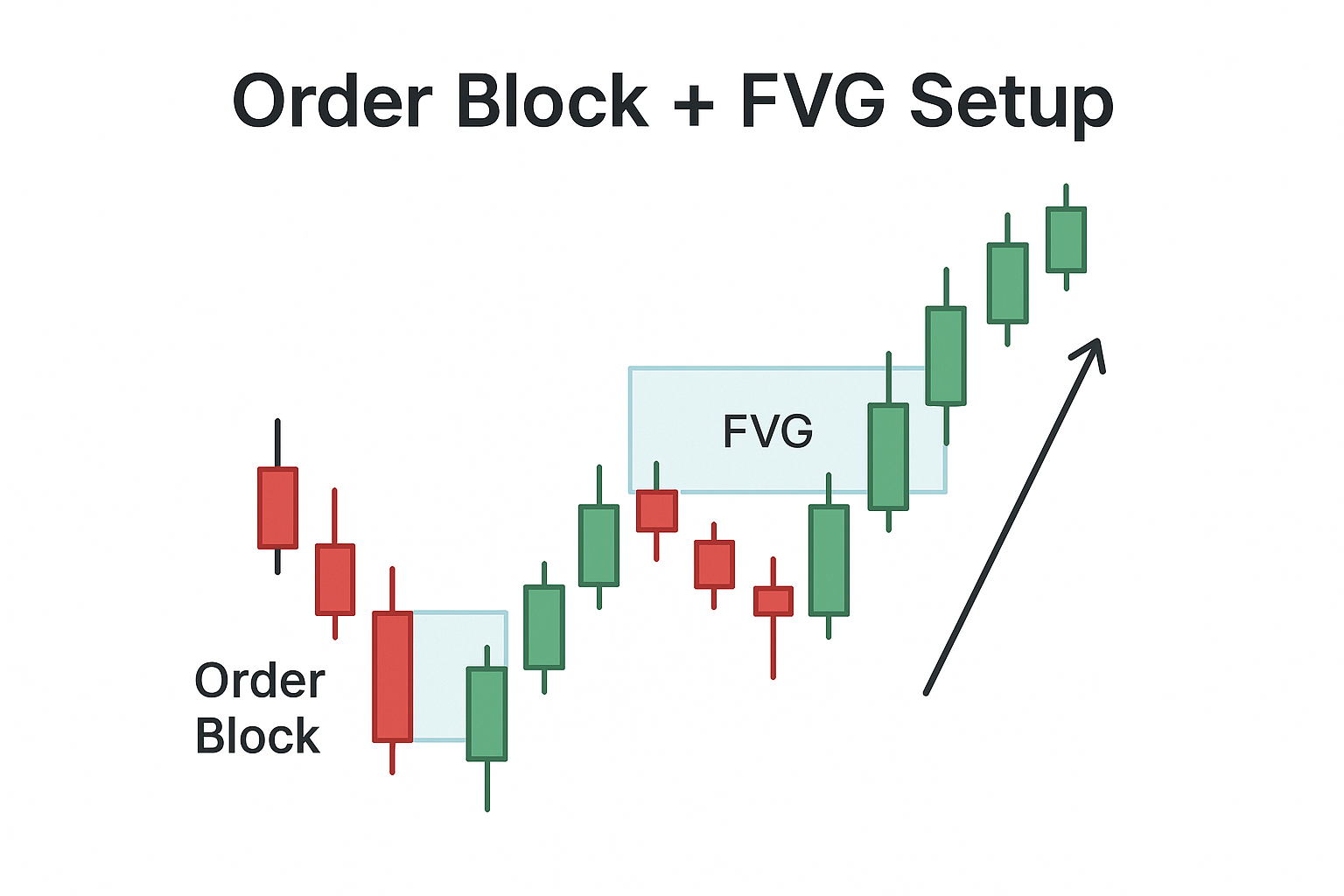

Execution models in SMC center on displacement and mitigation. The core tools—Order Blocks and Fair Value Gaps—define where price is likely to rebalance after an impulse. Remember: only take entries from fresh levels within higher-timeframe areas (premium for shorts, discount for longs) and in alignment with the established bias.

An Order Block (OB) is the last opposing candle (or small cluster) before a strong displacement move. It represents institutional decision-making where inventory was accumulated before the impulse. In order block strategy forex, we:

Entry, SL, TP:

Quality filters:

A Fair Value Gap is a three-candle imbalance where the middle candle’s body and wick create a pricing void between the first and third candles (no overlap). It signals inefficient delivery; price often returns to fill or partially mitigate it. In fair value gap fvg forex execution:

Management:

Notes:

A Breaker Block is a failed Order Block whose level flips function after invalidation. If price rallies from a bullish OB but later breaks decisively below it, that old OB can transform into resistance upon retest (and vice versa for bearish OB -> support). Practical steps:

Use case:

SMC overlaps with classical supply and demand analysis but is more precise about how and why price revisits zones. In supply and demand zones forex, traders highlight areas of prior imbalance where price may react. SMC refines this by:

Bottom line: While S/D offers the conceptual “where,” SMC adds “when” and “why” via market structure, liquidity engineering, and delivery efficiency.

Smart money concepts forex is a complete execution framework that unifies structure, liquidity, and balanced delivery. The process is consistent: set higher-timeframe bias (H4/Daily), locate areas of interest, wait for liquidity events (sweeps/inducements), and execute on fresh OB/FVG mitigations on M5/M15 with defined invalidation. The ict trading strategy forex principles do not replace risk management—every position requires a hard stop beyond the OB or the liquidity collection point, and every setup must respect freshness and context.