The martingale forex strategy is a structured position-sizing approach used in currency trading. This guide explains how it works, why position size doubles, how risk can grow as size increases, and how money management and automation are typically configured. The core message is discipline: martingale can produce frequent small realized profits, but it concentrates risk into rare losing streaks, so clearly defined limits and risk controls are essential.

Martingale is a position-sizing rule where a trader doubles the lot size after each loss, aiming for a single subsequent win to recover all prior losses and achieve the original profit target. It originated in 18th-century casino play, where a bettor would double the stake after a loss on even-odds games (like red/black). In markets, the same logic is applied to trade size, not to predicting direction or timing.

After a loss, the next trade’s lot size is doubled. If the setup has a 1:1 target-to-stop distance (for simplicity), a single winning trade after any series of losses will cover the accumulated losses plus the initial target profit. That is the appeal: a high frequency of small realized profits and the impression of “near certainty” of recovery—until a long losing streak occurs.

Below is a simple loss–loss–loss–win sequence with a fixed pip target and stop, showing how one win can recover all prior losses when position size doubles each step.

| Step | Outcome | Lot size | P/L at step | Cumulative P/L |

|---|---|---|---|---|

| 1 | Loss | 0.10 | -$10 | -$10 |

| 2 | Loss | 0.20 | -$20 | -$30 |

| 3 | Loss | 0.40 | -$40 | -$70 |

| 4 | Loss | 0.80 | -$80 | -$150 |

| 5 | Win | 1.60 | +$160 | +$10 |

In this illustration, a single win at step 5 recovers the $150 of accumulated losses and realizes the initial $10 target. The catch is capital: lot size and potential drawdown grow exponentially with each loss.

Martingale offers the appearance of near-certain recovery, yet it concentrates risk in rare but inevitable long losing streaks. With finite capital, the probability of catastrophic loss (ruin) is non-zero and increases with every additional doubling step. This is why professionals emphasize using clear limits with martingale: recovery depends on having enough capital and margin to sustain a sequence of losses, and those resources are always finite in live trading.

Critical risk points to understand:

This strategy requires experience, strict limits, and careful risk control.

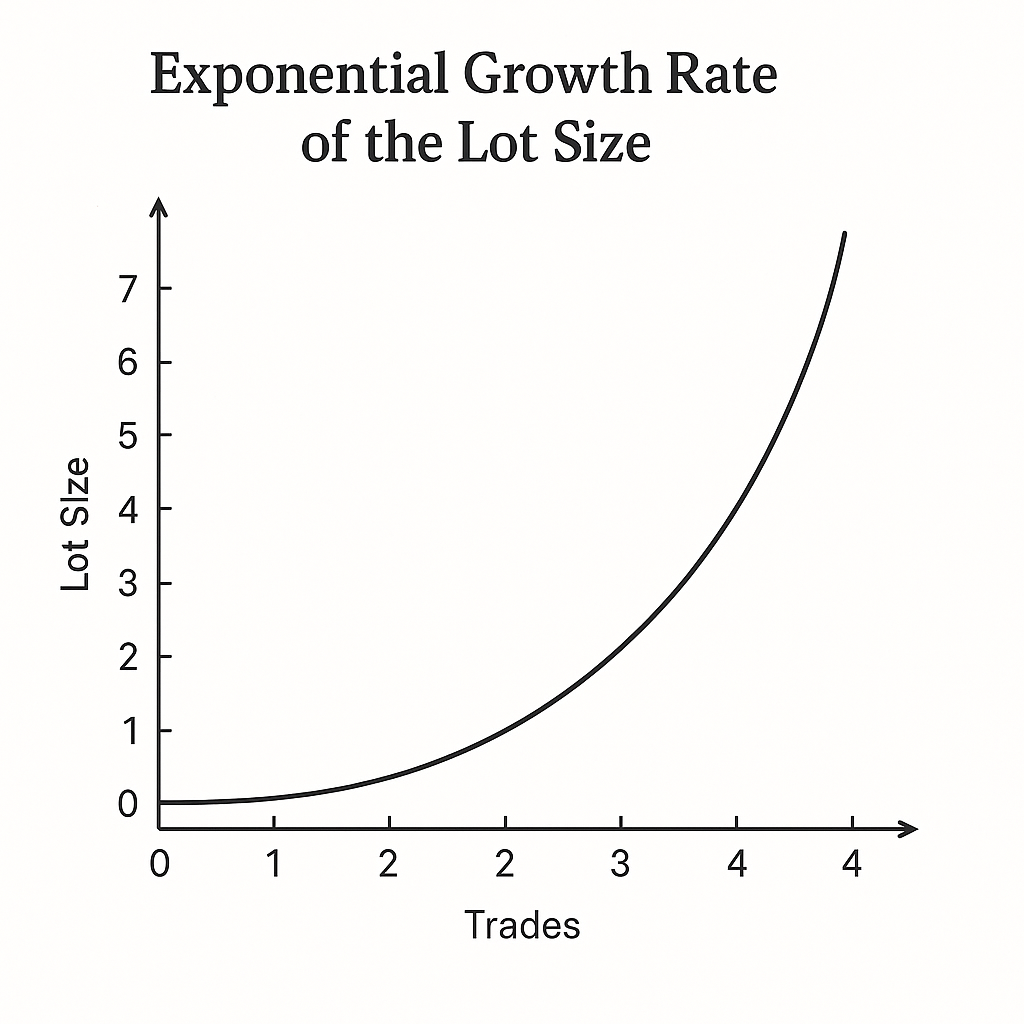

The cumulative exposure of martingale rises roughly with the geometric series of lot sizes. If the base lot is L and the multiplier is 2, then after n losses the next lot is L × 2^n, and the total exposure and potential drawdown grow on the order of (2^(n+1) − 1) × L in profit/loss units (assuming symmetric stops and targets). A losing streak of 8–10 steps, while rare, is not implausible. When it arrives, the required next position size and drawdown buffer often exceed account equity and margin capacity.

Other compounding risks:

The exponential curve highlights why blowouts are sudden and large: exposure and required margin escalate sharply after a few losses.

Leverage and margin are hard limits on martingale chains. Each doubling step requires more margin, while unrealized losses consume equity. As both margin requirements and drawdown rise, free margin collapses and the account is stopped out before the “eventual win.”

Practical constraints:

These realities make the infinite-capital assumption impossible in forex. The strategy’s structural tail risk remains, no matter how “safe” prior results looked.

If martingale is attempted at all, it must be framed as position sizing with precisely defined, hard limits and with only a minimal percentage of total capital at risk. It does not predict the market; it only manages size after outcomes. The following guidelines describe how practitioners try to constrain risk, but none of them remove the fundamental blowout risk.

Even with these controls, the risk of bankruptcy remains the key rule: a sufficiently long adverse streak can still exceed limits, resulting in a large loss relative to accrued profits.

A common implementation is the martingale grid forex approach: place a series of buy or sell orders at fixed price intervals (a grid). As price moves against the initial entry, additional orders are placed with larger lot sizes per the martingale multiplier. When price reverts to the average entry plus a small target, the entire basket closes for net profit.

Typical features:

This design can harvest small oscillations in ranging markets but is highly vulnerable to sustained trends against the grid’s direction.

Automation simplifies execution but accelerates exposure during adverse moves, which is why strict limits on maximum steps, lot size, and drawdown are mandatory.

In martingale vs DCA forex, the two concepts are often conflated but are fundamentally different:

In short, DCA is an averaging technique with linear capital deployment, while martingale is a recovery technique with geometric capital deployment.

Most martingale systems are fully automated due to the mechanical nature of entry spacing and size escalation. However, automation does not remove structural risk; it compounds execution speed and therefore demands uncompromising limits. Equally important is careful evaluation and staged rollout, because results can look deceptively smooth until a rare streak appears.

A typical martingale EA forex implements rules for entry placement, lot multipliers, basket targets, and safety stops. Selecting robust martingale settings forex is critical; they control how quickly exposure grows and how often the system reaches its limits.

Common parameters and considerations:

Platform notes:

No configuration can offset the core reality: the longer the adverse sequence, the more likely the system will exceed its preset limits. Risk controls reduce frequency and magnitude of failure but cannot remove it.

The martingale forex strategy can appear attractive because one win after losses recovers all prior losses and books a small profit. However, it achieves this by concentrating risk into rare long losing streaks that require rapidly increasing size. In real markets with finite equity, broker margin, slippage, and gaps, the assumption of unlimited recovery is not realistic. The core tradeoff is simple: frequent small gains versus the possibility of a large loss if a losing streak reaches your limits.

This approach requires experience, strict limits, and careful risk control. If used at all, it should be limited to a minimal percentage of capital in a segregated sub-account, with uncompromising rules for maximum lot, maximum steps, and maximum drawdown, plus global equity and margin protections. Above all, be clear about what martingale is and is not: it does not predict the market; it only manages position size.