Dollar-Cost Averaging (DCA) in Forex: Strategy, Risks, and How to Scale In

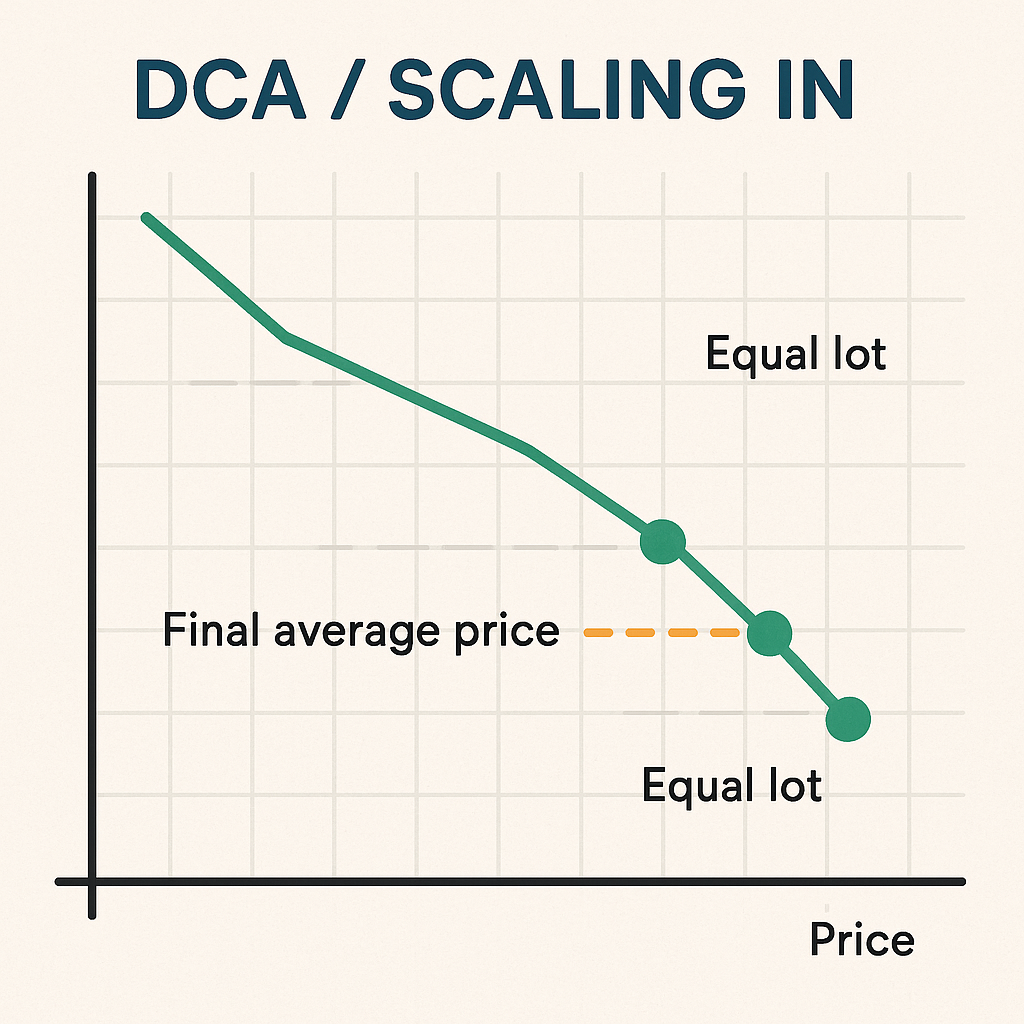

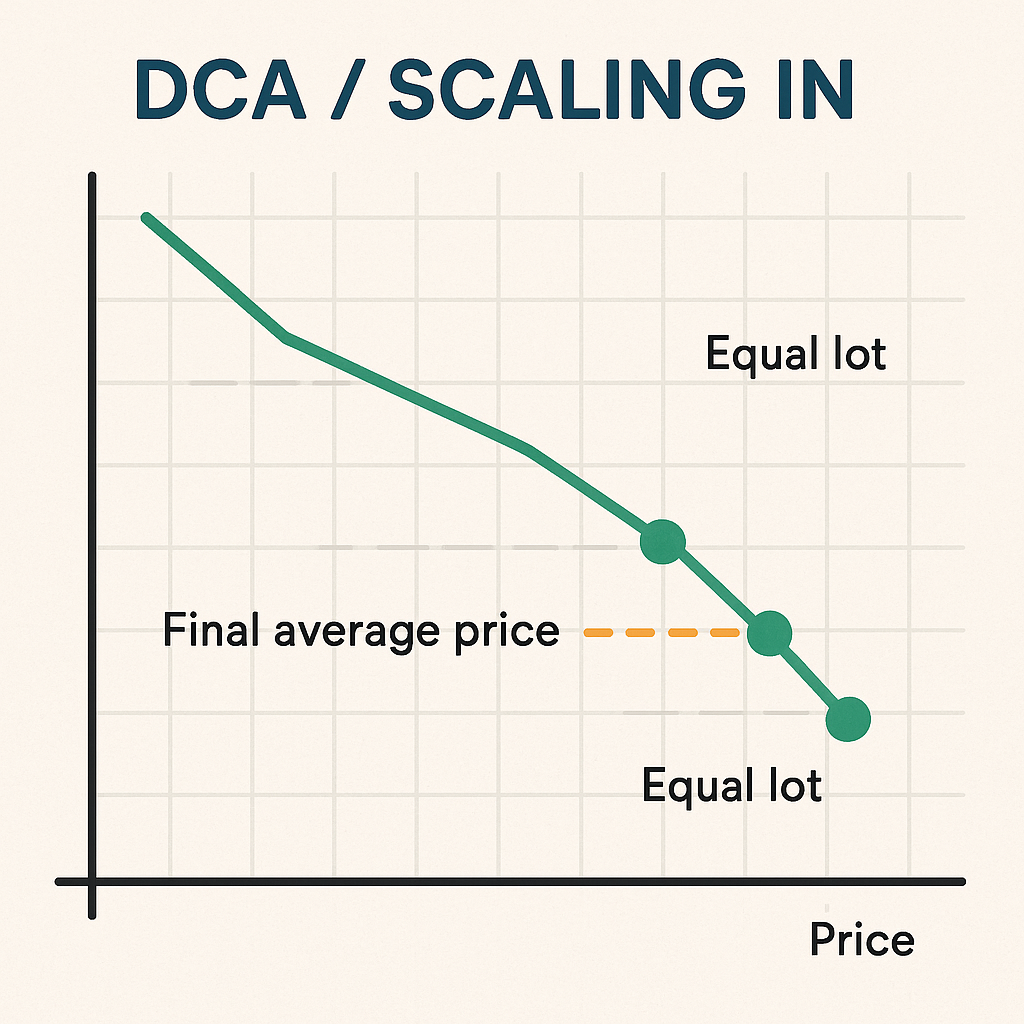

Dollar-cost averaging (DCA) splits a position into smaller entries placed over time or across price levels. The goal is to reduce reliance on a single entry price and make execution more systematic.

What is Dollar-Cost Averaging (DCA)?

Dollar-cost averaging is an investment technique where capital is divided into smaller, scheduled purchases to reduce the impact of entering the market at an unfavorable moment. Instead of committing a lump sum at once, the trader or investor distributes entries over time or price levels, smoothing the entry price and reducing “timing the market” risk.

In traditional markets (stocks, ETFs), DCA aims to reduce volatility of entry costs and lessen the emotional burden of trying to pick perfect tops or bottoms. The concept translates into foreign exchange as well, but with important differences. In practice, dollar cost averaging forex involves scaling into a position as price moves into pre-planned levels. In FX this often means adding during an adverse move, which is why a hard basket-level loss limit is essential. This is a form of cost averaging currency trading that must account for leverage, margin, and the 24/5 nature of FX markets. Because forex trading is typically leveraged and mean reversion is not guaranteed, risk controls and hard loss limits are essential.

Key idea: DCA attempts to reduce the sensitivity of results to a single entry price. It does not eliminate risk or guarantee profits; it shifts how risk is taken over price and time.

Adapting DCA to Forex Trading (DCA Forex Strategy)

In long-term investing, DCA spreads buys across time regardless of short-term price noise. In forex, the DCA forex strategy is often applied as multiple entries at pre-defined price intervals (for example, every 50 pips against the initial position), sometimes called scaling in or position averaging. The goal is to lower the average entry price (for longs) or raise it (for shorts) so that a smaller retracement can bring the trade to break-even or profit.

Key differences from long-term investing:

- Leverage and margin: Forex trades are usually leveraged, magnifying both gains and losses. Averaging into a losing position increases exposure as price moves against the trader, raising margin usage and drawdown risk.

- No long-run upward drift: Unlike broad equities, currency pairs don’t have a guaranteed upward drift; they reflect relative value between economies and can trend for long periods. DCA against a strong trend can be hazardous.

- Financing costs and swaps: Holding leveraged positions overnight can incur swap/financing costs, which can accumulate when multiple positions are open.

In forex, DCA is less about “time diversification” and more about “price-level diversification” under adverse price movement. This requires a rules-based approach, explicit risk limits, and clear invalidation points for the entire grouped position.

How Scaling In Works in Currency Trading

- Scaling in forex strategy, also known as progressive entries forex or position averaging forex, is the practice of adding positions in smaller increments as price moves into your predefined zones. A trader defines:

- Maximum risk for the entire idea (e.g., 1% of account).

- Number of planned entries (e.g., 3–5 tranches).

- Spacing between entries (e.g., every 40–75 pips).

- A collective stop loss that caps total loss for the averaged position.

- Exit rules (target, time stop, or structure break).

- Within this framework, scaling in balances precision and flexibility: the first entry plants a “stake,” and additional tranches improve the average entry price if the market offers better levels—without abandoning the original thesis or risk budget.

How Scaling In Works in Currency Trading – Practical DCA Example

| Step |

Action |

Price (EUR/USD) |

Lot Size |

Cumulative Size |

Distance From Last Entry (pips) |

Weighted Avg Entry |

| 1 |

Buy |

1.1000 |

0.50 |

0.50 |

— |

1.1000 |

| 2 |

Buy |

1.0950 |

0.50 |

1.00 |

50 |

1.0975 |

| 3 |

Buy |

1.0900 |

0.50 |

1.50 |

50 |

1.0950 |

| 4 |

Buy |

1.0850 |

0.50 |

2.00 |

50 |

1.0925 |

Interpretation:

- With four equal tranches 50 pips apart, the weighted average entry becomes 1.0925. A smaller rebound is needed to break even compared to entering the full size at 1.1000.

- This convenience comes at a cost: total exposure increases with each addition, raising margin usage and drawdown if price continues lower.

Practical implementation notes:

- Spacing decisions: Wider spacing reduces the chance of “stacking” too quickly in a trend but may miss entries. Tighter spacing increases fill probability but raises correlation between entries.

- Sizing schemes: Equal-size tranches are simplest. Some traders use decreasing sizes to temper risk or, more aggressively (riskier), increasing sizes. Avoid martingale-like escalation that grows size as losses mount.

- Pre-commit the maximum number of entries. If the plan allows four tranches, add only four. Do not add a fifth without revising the trade thesis and risk budget.

DCA in Practice: Buy Orders vs. Sell Orders

Long example (EUR/USD):

- Thesis: EUR/USD is in a larger range; a downside probe into support is likely to mean-revert.

- Plan: First buy at 1.1000 (0.5 lot), add at 1.0950, 1.0900, 1.0850 (each 0.5 lot), average 1.0925. Collective stop at 1.0800 based on the higher-timeframe structure, capping total loss at the predefined risk (e.g., 1% of equity). Target partial exits near 1.0975–1.1000 where liquidity and prior structure exist, then manage the remainder using a structure-based exit plan (e.g., next key level or a discretionary trailing approach).

Short example (GBP/USD):

- Thesis: GBP/USD rallies into resistance but macro remains USD-supportive; expecting pullback.

- Plan: First short at 1.2700, adds at 1.2750 and 1.2800 with equal tranches; average short near 1.2750. Collective stop at 1.2875 where the thesis is invalidated. Take partial profits near 1.2680–1.2660 on a fade back into the range.

Operational guidance:

- Always define the invalidation level first, then design entries around it so that the worst-case loss fits within the risk budget.

- Avoid averaging during impulsive events (major data releases), where slippage and gaps can invalidate price-based spacing.

- Never allow “averaging down” to replace analysis. If the structure breaks (e.g., range-to-trend transition), stop out and reassess.

DCA vs. Lump Sum Investment in Forex (DCA vs Lump Sum Forex)

Both approaches seek to manage entry risk, but they emphasize different trade-offs. DCA staggers entries to reduce sensitivity to a single price, while lump sum commits full size upfront to maximize participation if the thesis immediately proves correct. In forex, where leverage magnifies outcomes, the correct choice depends on volatility regime, conviction, and risk tolerance.

DCA for Risk Mitigation vs. Capital Efficiency

| Criteria |

DCA in Forex |

Lump Sum in Forex |

| Entry timing risk |

Reduced via staggered entries across levels |

High: full exposure at a single price |

| Capital efficiency |

Lower if price moves immediately your way |

Higher if direction and timing are correct |

| Drawdown profile |

Smoother per tranche; can compound if trend persists against you |

Immediate and potentially large if mistimed |

| Margin usage |

Ramps up as more tranches fill; must be pre-planned |

Known upfront; simpler to monitor |

| Execution complexity |

Higher: multiple orders, spacing, and tracking |

Lower: single order and straightforward management |

| Suitability by regime |

Better in ranges/mean reversion with clear invalidation |

Better in strong trends with decisive breakout/continuation signals |

| Psychological load |

Lower regret on initial mis-timing; risk of complacency |

Higher initial stress; clearer invalidation adherence |

| Stop-loss design |

One collective stop for the whole basket is essential |

Single-position stop; simpler to implement |

| Financing (swap) |

Multiple legs can amplify overnight costs |

Single leg; easier to estimate costs |

| Catastrophic risk |

Elevated if averaging down without strict limits |

Elevated if no stop, but simpler to cap with one stop |

Takeaway: In leveraged FX, DCA vs lump sum forex is not simply about comfort with timing—it is about risk containment. DCA must be coupled with strict loss limits to avoid compounding exposure into a persistent trend. Lump sum demands high conviction and crisp invalidation from the outset.

The Major Risks of DCA in Forex (DCA Risks Forex)

The main pitfall is assuming DCA in forex functions like DCA in stocks. In equities, diversified indices may exhibit long-term upward drift; averaging into weakness can ultimately recover as cycles turn. In FX, a pair can trend for months or years driven by interest rate differentials, central bank policy, or macro shocks. Averaging against such trends magnifies exposure under leverage, quickly approaching margin stress.

Risk factors unique to forex:

- Leverage and margin: Small adverse moves create large equity swings; adding tranches accelerates used margin and drawdown.

- Trend persistence: Strong macro trends (e.g., policy divergence) can invalidate mean-reversion expectations.

- Swap/financing: Holding multi-leg positions accrues financing costs; negative carry worsens P/L over time.

- Liquidity pockets and gaps: News releases can cause gaps through stops, producing larger-than-planned losses.

- Correlated exposure: Multiple pairs can move together (USD strength/weakness cycles). “Diversifying” DCA across correlated pairs can compound risk unintentionally.

Bottom line: DCA in forex is viable only within a defined risk envelope—fixed maximum loss for the entire averaged position, controlled number of additions, and a hard invalidation level that is respected without exception.

The Margin Call Risk and Leveraging Danger

Averaging into a losing position increases not just position size but also margin consumption. If price continues in the adverse direction, equity declines while used margin rises, shrinking free margin. When free margin falls below broker thresholds, positions can be forcibly liquidated (margin call/stop out), often at the worst moment.

Comparison with Martingale/Anti-Martingale:

- Martingale increases size after losses to recover with a small move; this is extremely dangerous under leverage and can end in a single catastrophic loss.

- Anti-Martingale increases size after wins; while risky if overdone, it compounds with momentum and is not averaging losers.

- DCA that adds equal or larger size as price moves against you resembles a mild Martingale. Without a predefined stop for the entire basket, it can drift toward the same catastrophic dynamic.

Illustrative path (EUR/USD, 1:30 leverage):

- Account: $20,000; initial buy 0.5 lot at 1.1000. Price drops 50 pips per addition across four tranches to 1.0850. Total size 2.0 lots; average 1.0925.

- A further 150-pip decline from average to 1.0775 equates to roughly -$3,000 on 2.0 lots (about -15% of equity), excluding swaps/commissions.

- If the plan keeps adding beyond the pre-planned four tranches, exposure can snowball while equity shrinks—raising the probability of a margin call before any rebound.

Key protections:

- Predefine the maximum number of entries and total size. No exceptions.

- Set a collective stop loss on the averaged position that caps loss at a fixed percentage of equity.

- Monitor margin level; keep a meaningful free-margin buffer so normal spikes and spread widening don’t force liquidation. The exact threshold depends on broker rules and the pair’s behavior—plan conservatively.

Avoiding the Trap of “Averaging Down” Indefinitely

The discipline that makes DCA useful also prevents it from turning into an unlimited averaging-down scheme:

- Collective stop loss: One hard stop for the entire basket at a technically and risk-adjusted level. The stop is based on invalidation of the thesis, not on comfort.

- Maximum additions: Define and honor the number of tranches and the spacing. Stop adding once you hit the limit.

- Risk budget first: Design tranche size and spacing from the stop backward so the worst-case loss equals your intended risk (e.g., 0.5–1.5% per idea).

- Time stop: If the setup fails to resolve within a defined time window or event risk changes (e.g., central bank decision), exit.

- Structure-based exits: If the market transitions from range to trend against your position (e.g., breaks and holds beyond a key weekly level), stop out rather than “hope” the average catches up.

- No escalation in size: Avoid increasing tranche size as losses mount. This drifts toward Martingale behavior and steepens the loss curve.

Implementing DCA with Automation (Optional)

Automation (where available) can help place staged entries, enforce a maximum number of additions, and apply a single basket-level stop. The key is not the tool—it’s the rules: hard loss limit, capped additions, and conservative margin usage.

Automation cautions:

- Many grid/averaging EAs default to adding without hard global stops—this is the failure point. Enforce a collective stop and maximum number of entries.

- If you evaluate the approach historically, include realistic spreads, swaps, and slippage—especially around major news—so results don’t look better than live conditions.

- Monitor margin and disable trading around scheduled risk (e.g., NFP, CPI, central bank decisions) if your strategy is sensitive to gaps.

Automation improves consistency, not strategy quality. The edge still depends on sound analysis, regime awareness, and strict risk limits.

Conclusion: Is DCA a Viable Strategy for Forex Traders?

DCA can be viable in forex when it is implemented as a structured, risk-first method of scaling in—never as open-ended “averaging down.” The technique can reduce entry timing risk in ranges and during controlled retests, but it must acknowledge the realities of leverage, margin, and trend persistence. A trader using dollar cost averaging forex should predefine the maximum number of entries, spacing, total position size, and one collective stop that caps loss at a fixed, acceptable percentage of equity.

In short:

- Use DCA to express a thesis with price-level diversification, not to rescue a broken idea.

- Keep the plan mechanical: risk budget first, entries second, exits third.

- Respect invalidation and event risk; avoid adding through structural breaks.

- If you automate, enforce global stops and conservative margin usage.

Executed with discipline and strict risk management, DCA can be a practical tool in the FX toolkit. Without those safeguards, cost averaging becomes a path to compounding exposure and potential catastrophic loss.