Mean Reversion Forex Strategy: Trading Contrarian Moves, Statistical Reversion, and Pairs

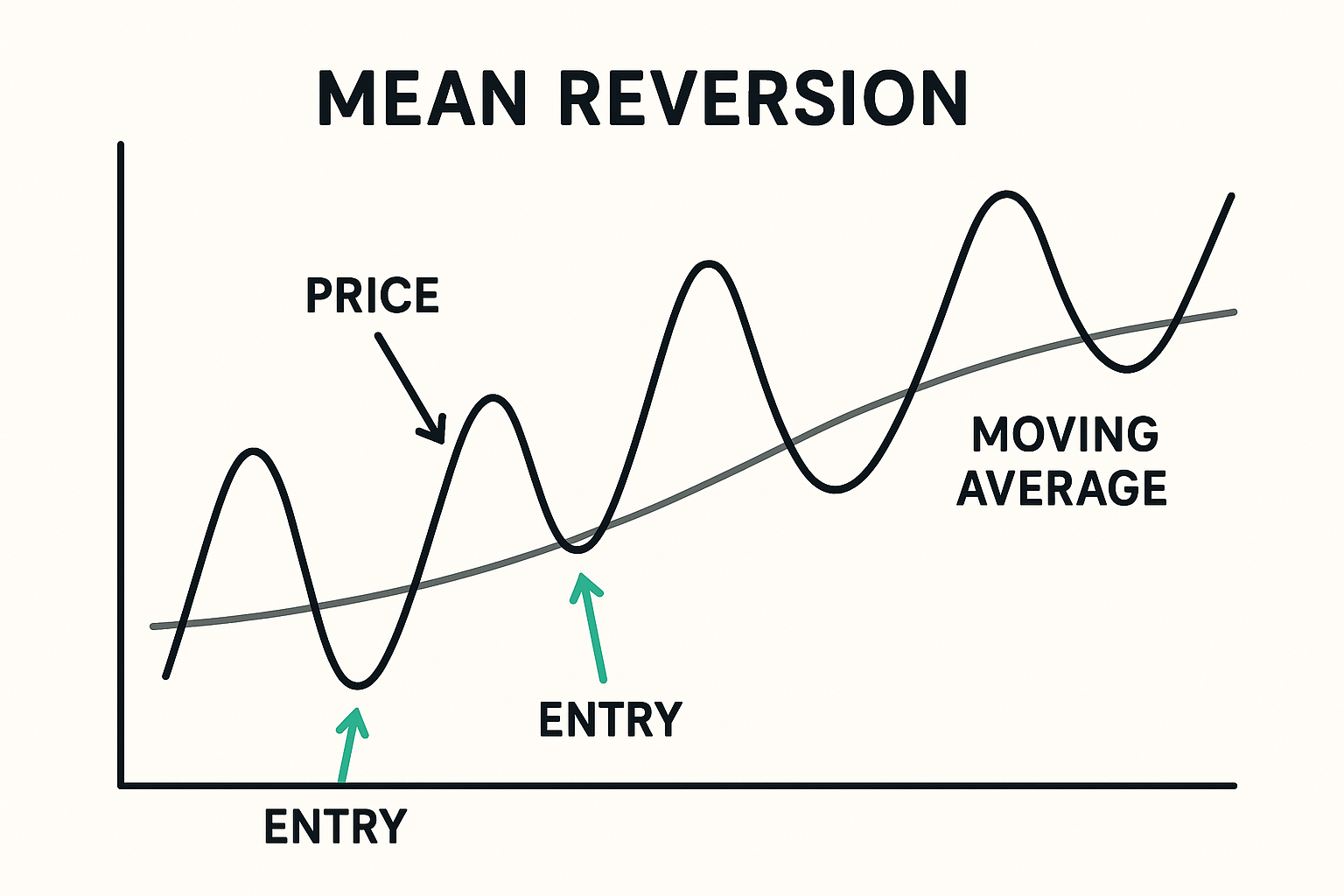

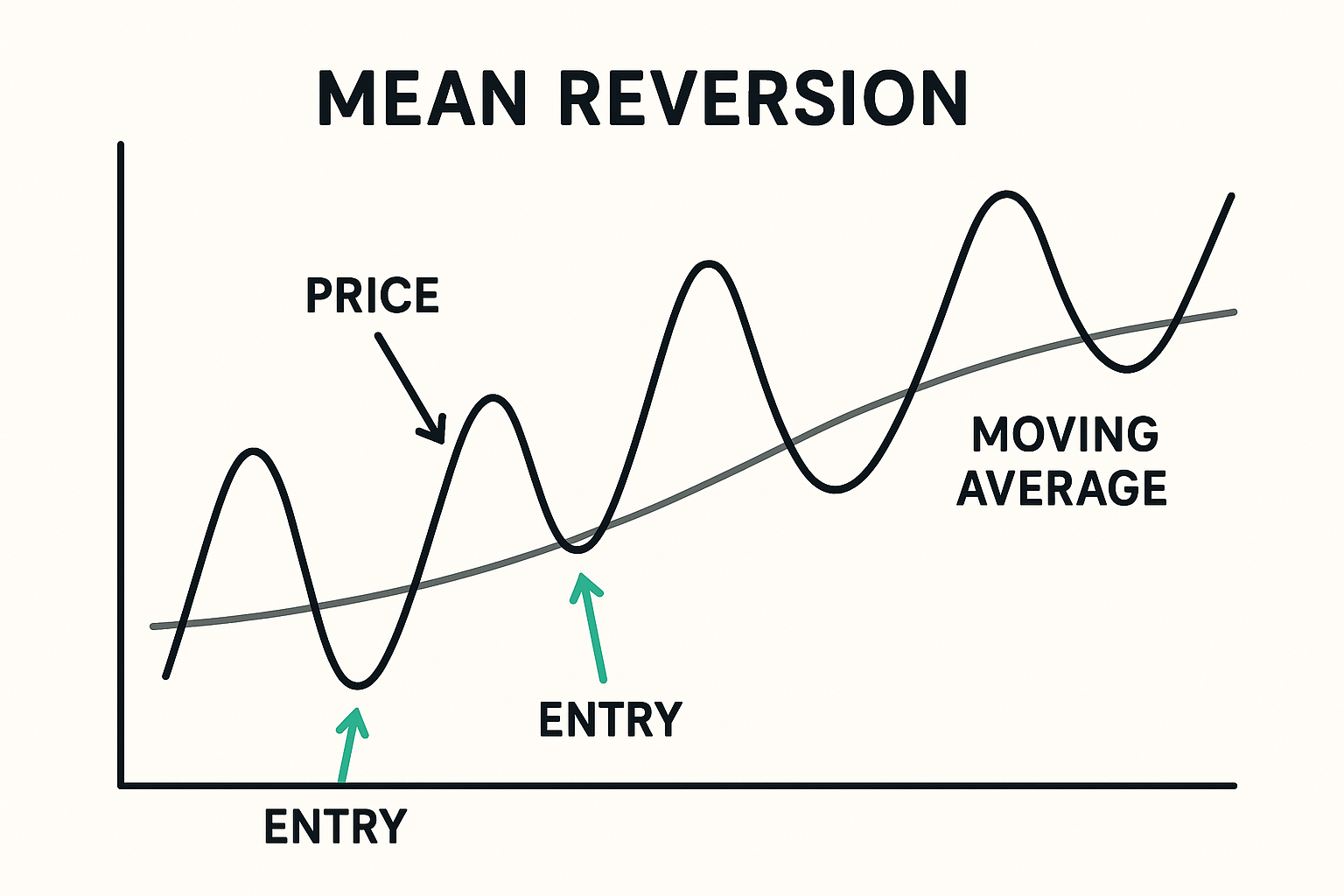

Mean reversion forex strategy focuses on capturing price snapping back to a typical value after an extreme move. It is a disciplined, rules-based approach that fades short-term extensions away from an average, on the premise that volatility expands and contracts while prices oscillate around a mean. As a contrarian forex strategy, it sits opposite trend-following: instead of riding momentum, you wait for exhaustion and require confirmation that price has turned back toward the average.

What is Mean Reversion in Financial Markets? (Reversion to the Mean Forex)

Mean reversion is the tendency of price to move back toward a historical average after deviating materially from it. In practice, traders measure the “mean” with a moving average or a statistically derived baseline and then look for signs that an overextended move is losing steam and reverting. The phrase reversion to the mean forex highlights the same idea in currency markets: when price stretches far from its typical value, it often retraces toward that value, especially in range-bound conditions.

This is a contrarian approach at its core. Instead of chasing a breakout, you fade extremes—only after confirmation—expecting the market to normalize. The confirmation requirement is essential. Do not sell simply because price touched an upper band or buy just because price touched a lower band. Mean reversion entries should be triggered by a clear bounce signal, such as a rejection wick, close back inside a band, or a momentum cross back toward neutral.

Context is non-negotiable. Mean reversion methods are effective primarily in balanced markets with oscillatory behavior. They are risky when a strong directional phase erupts, because extensions can keep extending. If your trade moves quickly against you after entry, assume a trend may be unfolding and exit via a tight Stop Loss.

Mean Reversion vs. Trend Following

| Criterion |

Mean Reversion |

Trend Following |

| Market Condition |

Best in ranges/consolidation; struggles during strong breakouts or sustained trends. |

Best in persistent directional markets; struggles in choppy ranges. |

| Risk |

Counter-move risk: extensions may keep extending; requires fast exits when wrong. |

Whipsaw risk: frequent small losses until a trend holds. |

| Stop Loss Placement |

Tight, just beyond the recent extreme; small distance but can be hit often. |

Wider, beyond structure on pullbacks; fewer hits but larger distance. |

The key takeaway: choose an approach that matches current market structure. Do not force mean reversion during a fresh trend leg; wait for evidence of balance.

Mean Reversion Strategies Using Volatility Indicators

Volatility-based tools quantify how far price has stretched from its mean. Bands define “typical” variation. When price pushes outside these boundaries and then snaps back inside with a clear rejection, the case for a move toward the mean improves—provided the market is ranging, not trending.

Use the band to identify extension; use price action to confirm the turn.

- Place tight Stops just beyond the extreme; if price invalidates the setup, exit immediately.

Bollinger Bands Mean Reversion

Bollinger Bands plot a middle line (commonly a 20-period simple moving average) with upper and lower bands at a set number of standard deviations. In bollinger mean reversion, a typical setup involves:

- Context filter: Favor flat to gently oscillating markets. Avoid expanding, one-direction volatility regimes.

- Extension criterion: Price closes outside a band or prints an exhaustion wick beyond it.

- Confirmation: Wait for a close back inside the band or a clear rejection candle. Do not enter on first touch.

- Entry: Fade in the direction of the mean (i.e., short from upper band rejection toward the SMA; long from lower band rejection toward the SMA).

- Exit: First target is the middle band (the mean). Partials can be left for the far band if the market remains range-bound.

- Stop Loss: Just beyond the extreme wick high/low or a few pips outside the band. If price re-extends, assume continuation and exit—no hesitation.

Advanced refinements include:

- Band width as a regime gauge: Narrow bands imply compression and more frequent reversions; rapidly widening bands can warn of breakout conditions.

- Multi-timeframe alignment: Ensure the higher timeframe is ranging; use the lower timeframe for fine-tuned entries after confirmation.

Trading the Overextended Move Fade (Overextended Move Fade Forex)

An overextension often ends with a “tail” or sharp retracement that rejects the extreme. The overextended move fade forex approach looks for recognizable exhaustion and immediate reversal evidence.

A practical checklist:

- Market state: Sideways or oscillatory. If a higher timeframe shows fresh momentum expansion, skip the fade.

- Extension cues: Long wicks beyond bands, climactic candles into prior range extremes, or a spike that instantly retraces.

- Confirmation: A close back inside the envelope, a lower high after a blow-off top (for shorts), or a higher low after a flush (for longs).

- Entry: Enter on the confirmation candle close or on a minor pullback following confirmation.

- Stop Loss: Above the blow-off wick (short) or below the flush wick (long), typically a few pips beyond structure.

- Management: Take first profits at the mean; move Stop to breakeven after partials. If price stalls before reaching the mean, reduce risk.

Remember: one candle does not make a reversion. Wait for a bounce signal. If the next candle extends further without rejection, step aside—continuations can be brutal against a fade.

Mean Reversion Using Oscillators

Oscillators compress price dynamics into a bounded momentum view. In range-bound regimes, extremes in oscillators often align with price stretching to range edges. Mean reversion entries form when the oscillator exits an extreme back toward neutral while price confirms a bounce.

Core principles:

- Use oscillator extremes to alert you, not to trigger blindly.

- Pair each oscillator signal with a price-based confirmation (e.g., a rejection wick or a clear turn back toward the range).

- Keep Stop Losses tight; momentum reversals can fail if a new trend emerges.

RSI Mean Reversion Forex

Relative Strength Index (RSI) is popular because it visually quantifies momentum extremes on a bounded scale. In rsi mean reversion forex:

- Setup: Identify RSI below 30 (potentially oversold) or above 70 (potentially overbought) in a market that is otherwise ranging.

- Confirmation: Wait for RSI to cross back above 30 (for a potential long) or back below 70 (for a potential short), ideally in tandem with a price action rejection at a range boundary or outside a volatility band.

- Entry: Execute on the confirmation candle close or a small pullback into the rejection candle’s body.

- Stop Loss: A few pips beyond the recent swing extreme or beyond the level used for context.

- Targets: First target at the midpoint of the range or the moving average mean; optional runner toward the opposite range edge if momentum fades smoothly.

Refinements:

- RSI divergences can strengthen a reversal case but should not replace confirmation.

- Consider dynamic RSI thresholds in fast markets (e.g., 80/20) to reduce premature entries.

Stochastics and Other Momentum Indicators

Stochastics, CCI, and similar tools operate on a comparable logic: identify extreme momentum readings, then require a turn back toward the middle alongside price confirmation. Stochastics crossovers out of the overbought/oversold zones work best when:

- The higher timeframe is range-bound.

- Price prints a rejection at a key level or envelope boundary.

- You enforce tight Stops and take partials at the mean.

Momentum oscillators should complement, not replace, the price-action filters that define your edge.

Advanced Mean Reversion Concepts

Advanced methods bring statistics and cross-asset relationships into the mean reversion toolkit. Keep explanations simple in practice and let your data guide parameter choices.

Statistical Mean Reversion Forex

Statistical tools help quantify “how far is far.” In statistical mean reversion forex, the two most accessible concepts are:

- Standard deviation: Measures how dispersed recent prices are around the average. One standard deviation contains roughly two-thirds of observations; two deviations capture most observations in a normal distribution. Bands based on this concept define “typical” versus “extreme” distance from the mean.

- Z-score: Expresses how many standard deviations current price is from its mean. A Z-score of +2 suggests price is two deviation units above the mean; −2 suggests two below. The higher the absolute Z-score, the more “unusual” the reading.

A simple workflow:

- Compute a rolling mean (e.g., 50-period) and rolling standard deviation over the same window.

- Calculate Z = (Price − Mean) / StdDev.

- Define extension thresholds (e.g., ±2). Consider entering only after Z crosses back inside the threshold and price confirms with a rejection candle.

- Exit targets: the mean (Z ≈ 0) for first profits; consider partials at ±1 for staged exits.

- Stop discipline: Place the Stop just beyond the extreme that produced the high Z-score. If Z pushes further out with price closing against you, exit—assume continuation risk.

Clarity and caution:

- Markets are not perfectly normal; thresholds are guidelines. Test per pair and session.

- Use Z-score as a filter, not a blind trigger. Price confirmation remains mandatory.

- During volatility regime shifts (news, opens), standard deviation inflates; recalibrate expectations or step aside.

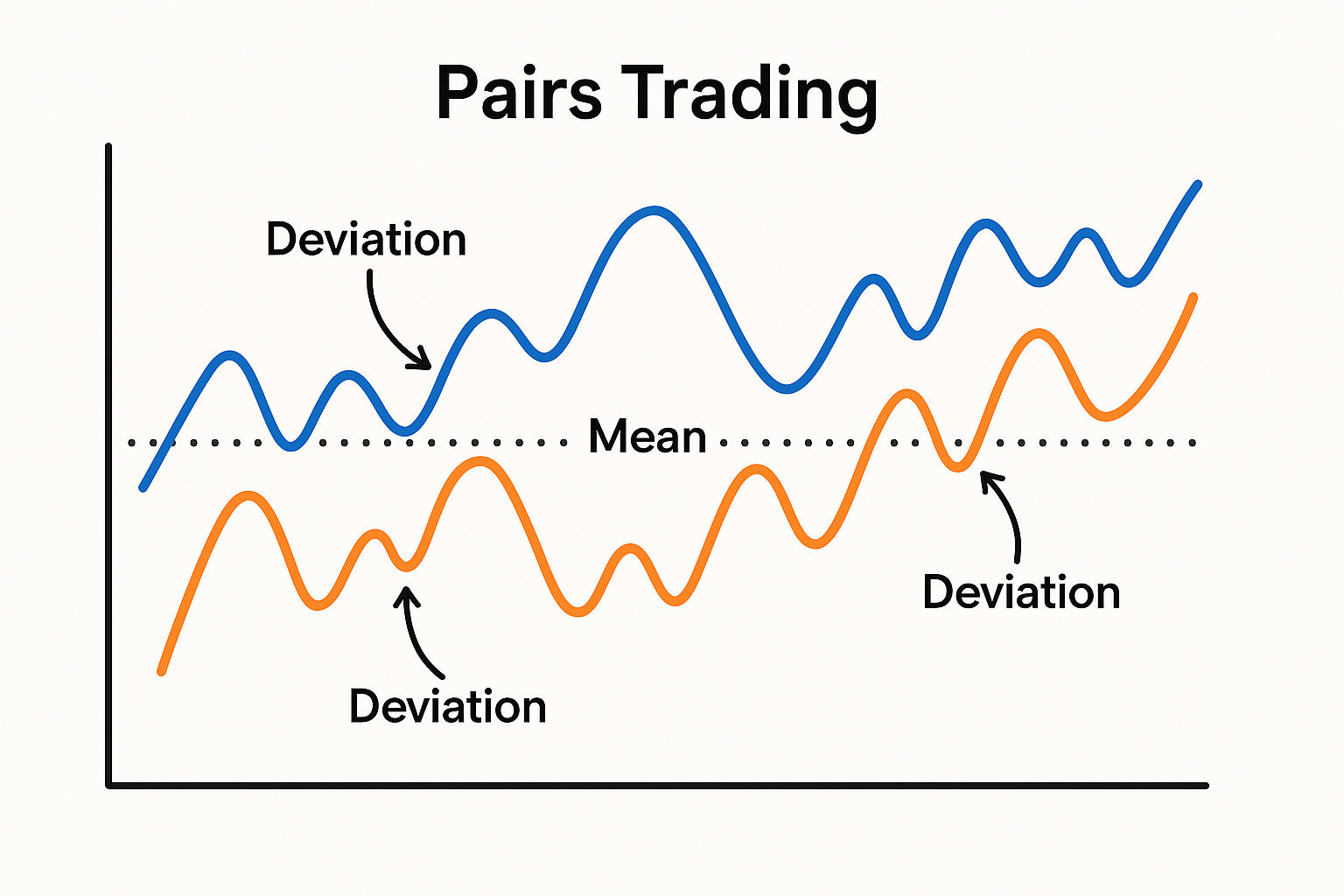

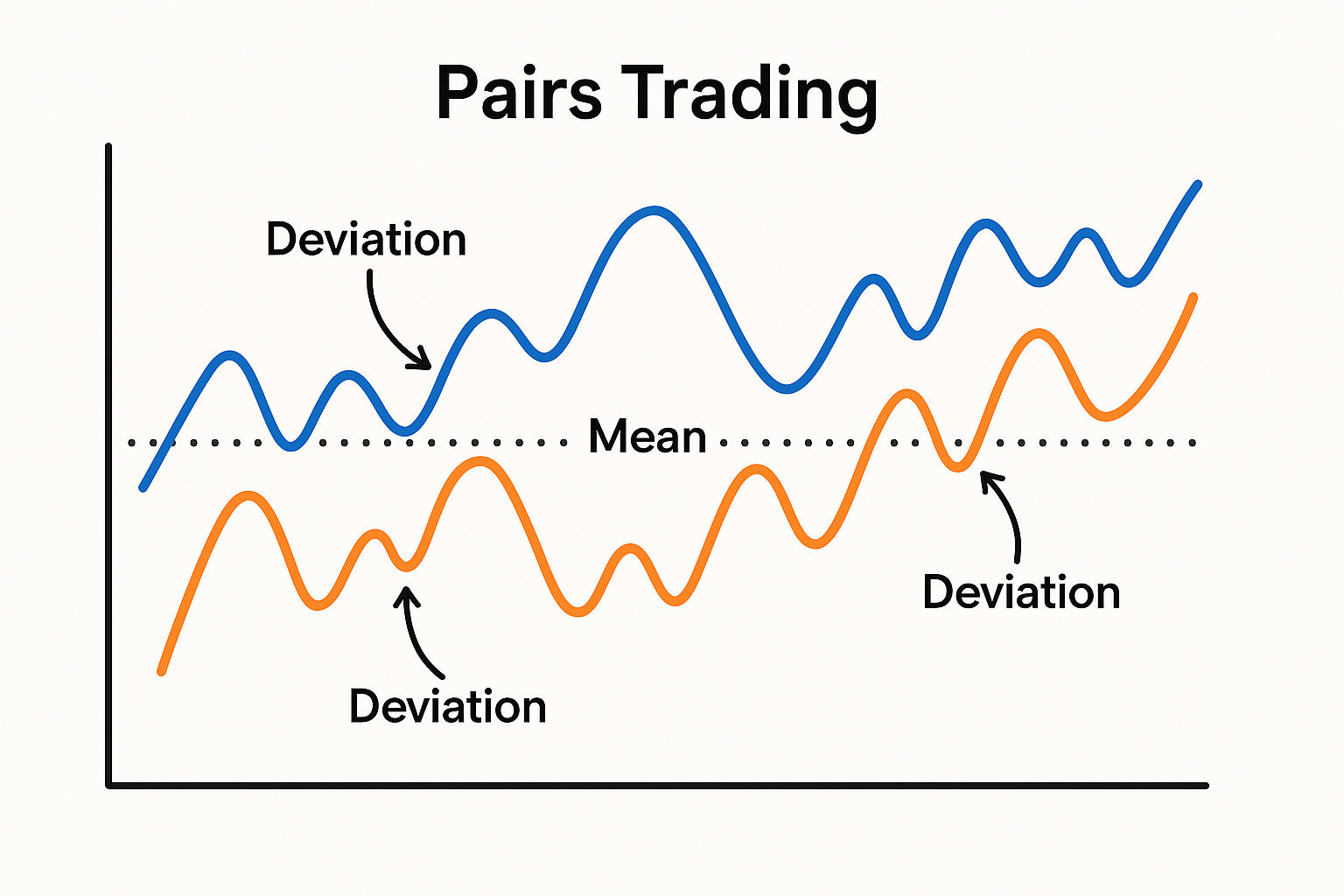

Pairs Trading: Mean Reversion (Pairs Mean Reversion)

Pairs trading applies reversion logic to the spread between two correlated instruments rather than the outright price of one. In forex, traders often compare related majors (e.g., EUR/USD and GBP/USD). When their spread deviates abnormally from its historical mean and then starts to revert, a pairs mean reversion opportunity may exist: long the laggard and short the leader, aiming for the spread to normalize.

Practical outline:

- Selection: Choose two highly related pairs whose prices co-move. Correlation is a starting point; relationships change, so re-evaluate regularly.

- Spread definition: Construct a synthetic spread (e.g., Price_A − Beta × Price_B), where Beta aligns scales via regression on a rolling window. Even a simple ratio can work as a first pass.

- Signal: Compute a rolling mean and standard deviation of the spread; monitor the spread’s Z-score. Look for large absolute Z that begins to revert, then confirm with a turn in the spread itself.

- Execution: Long the undervalued leg and short the overvalued leg sized by Beta, so the position is spread-neutral.

- Risk: Tight Stops on the spread. If divergence widens after entry, exit promptly; structural shifts (policy, macro) can break relationships.

Pairs reduce outright market direction risk, but they introduce model risk (relationship instability). Keep windows and parameters adaptive and size conservatively.

Applying Mean Reversion to Trading

Turning concept into practice requires a repeatable plan anchored to market context, confirmations, and strict risk controls.

Framework to deploy:

- Identify the regime.

- Use higher timeframe structure (e.g., H4/H1) to confirm a range: overlapping highs/lows, mean crossings, and a flat or gently waving moving average.

- Avoid fresh directional expansions and sessions with elevated event risk.

- Choose your toolset.

- Use either Bollinger Bands to quantify extension or one oscillator (RSI or Stochastics) to gauge momentum extremes.

- Use a price-action trigger.

- Define your entry trigger.

- Extension beyond boundary + confirmed bounce back toward the range.

- Do not enter on first touch; wait for evidence of failure at the extreme.

- Structure your exits in advance.

- First target at the mean; second at the far side of the range if conditions remain calm.

- Move Stop to breakeven after first partial.

- Enforce tight, mandatory Stops.

- Place Stops just beyond the invalidation point (the extreme). If price continues, assume trend risk and exit immediately.

- Manage operational factors.

- Prefer liquid sessions with tighter spreads.

- Avoid high-impact news windows; volatility regime shifts can negate mean reversion edges.

- Track slippage and execution speed; counter-trend entries often require decisive action.

Documentation and review:

- Keep a log of each trade’s context (range vs trend), trigger type, Stop distance, and outcome.

- Tag losing trades by failure mode (no confirmation, regime shift, late entry) to refine rules.

Mean Reversion Scalping

Mean reversion scalping applies the same principles on small timeframes (e.g., M1–M5). Short distances to the mean can produce frequent opportunities, but execution demands are high.

Key considerations:

- Only trade during liquid hours; wide spreads can erase edge on tiny targets.

- Prioritize instruments with consistently tight spreads.

- Use settings for bands suited to intraday volatility.

- Confirmation still matters: a one-candle spike without a clear rejection is not enough.

- Stops remain tight—often just a few pips beyond the wick. Targets are modest: the midline or micro-range midpoint.

- Expect a higher trade count and plan for commission/spread impact. Your expectancy must account for costs.

Scalping intensifies the importance of discipline. A single failure to exit quickly when wrong can offset several small wins.

Risk Management for Contrarian Trading

Counter-trend trading compresses risk into tight windows: it works well when ranges hold and fails fast when a trend begins. Your risk plan must reflect that reality.

Non-negotiables:

- Mandatory, tight Stop Loss: Place it just beyond the price extreme that defines your setup. If the market invalidates your thesis, accept the loss immediately.

- Confirmation before entry: Never fade a raw touch of a band or level. Wait for a rejection wick, a close back inside, or a momentum turn.

- Position sizing: Size for the Stop, not the target. Use consistent risk per trade (e.g., 0.25%–0.5%) to weather sequences.

- Regime filter: If higher timeframe volatility expands and price rides one side of the mean, stand aside. Do not fight a young trend.

- News and session awareness: Step back around major economic releases; one candle can skip your Stop.

- Review and adaptation: If you log multiple losses due to continuation moves, your regime filter is too permissive. Tighten it or reduce frequency.

Remember: survival is the edge. Mean reversion edges come from many small, controlled outcomes, not from outsized risk-taking.

Conclusion: When and Where Mean Reversion Works Best

The mean reversion forex strategy excels in balanced, ranging markets where price repeatedly oscillates around a stable average. It underperforms—and can become hazardous—when a new trend starts or volatility expands sharply. Success relies on three pillars: verifying market context, requiring confirmation of the bounce, and enforcing tight, mandatory Stop Losses. Use volatility envelopes or oscillators to define extensions and momentum turns, and clear rules to standardize entries, exits, and risk.

Applied with discipline, this approach captures the market’s tendency to normalize without guessing tops or bottoms. Focus on consolidation phases, respect confirmation, and protect every position. That is how the mean reversion forex strategy becomes a reliable, repeatable part of a professional toolkit.